5 Elements of a Strong Succession Plan

Could your company thrive without you? Keep your business growing and strong—and your family protected during the transition.

View our infographic illustrating 5 elements of a strong succession plan.

Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income based on your personal preferences and goals.

Pacific Life variable annuities are long-term investments that can help you grow your retirement savings through a diverse selection of investment options while deferring taxes until you’re ready to take retirement income.

A registered index-linked annuity is a tax-deferred contract that allows you to pursue growth without being invested directly in the market. Instead, growth is linked to the performance of an index (such as the S&P 500® index). It also provides levels of protection against the amount of loss you can incur.

Pacific Life fixed indexed annuities are designed to protect your principal while providing growth opportunity based on the positive movement of an index creating a source of income that lasts for life and providing a guaranteed death benefit for loved ones.

Protect and grow your principal at a fixed rate to create a source of lifetime income and help provide for loved ones through a death benefit with a Pacific Life fixed annuity.

With a Pacific Life immediate annuity you can receive reliable income payments that begin on a date you choose within one year of purchase and last for life.

A fixed, deferred income annuity from Pacific Life provides reliable income payments beginning on a future date the annuitant chooses.

Life insurance is most commonly used to help protect your family from any financial effects of your and/or your spouse's death. Protect your family's financial well-being with life insurance, which can pay a death benefit to help replace a lifetime of your loved one's lost earning potential.

A hallmark of variable universal life insurance (VUL) is flexibility. In addition to death benefit protection, VUL offers the ability to allocate among purely market-driven and guaranteed investment options. With such a wide range of investment options, you may adjust your policy’s allocations to meet a potential lifetime of growth objectives and risk tolerances—all in one flexible policy.

When you need death benefit protection, the right life insurance policy may also help protect against market downturns. Indexed universal life insurance (IUL) offers the growth potential of index-based interest crediting rates and the protection of guaranteed minimum interest crediting floors.

Quality term life insurance from a premier life insurance carrier. Protect your family or business for the term period of your choosing at competitive premiums.

Universal Life Insurance (UL) provides death benefit protection with cash value growth potential, guaranteed minimum interest crediting rates, and flexible options for customizing coverage for your needs.

Pacific Life offers a full range of employee benefits, available through your employer, for your added health and financial well-being.

From dental exams to paycheck protection, our coverages can help provide you and your family peace of mind.

Submit a claim for coverages available through your employer.

Introducing Pacific Life Workforce Benefits that deliver employee value and meet employers' needs for simplicity and dependability in an ever-changing workplace.

Reduce your administrative tasks and time with a powerful, yet simple approach to managing group benefits.

Quality benefits your employees can rely on that are easy and friction-free to use and manage.

The Institutional Retirement Solutions Group offers a holistic approach that provides a seamless and integrated experience for our clients. We leverage Pacific Life’s nearly 160 years of financial strength to deliver retirement security and solve the critical need for institutional income solutions.

A leader in the Pension Risk Transfer market since 1941, we help provide retirement security for participants and deliver best-in-class performance and high-touch client service.

Partnering with our clients to deliver customizable lifetime income solutions that cater to the full spectrum of retirement plan needs.

Introducing Pacific Life Workforce Benefits. A new, totally unified experience that integrates group benefits, from quotes to claims. Better for your clients. Better for your business.

Making you a hero for your clients with seamless solutions from start to finish.

Quality products your clients need that are easy and friction-free to use and manage.

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income based on your personal preferences and goals.

Pacific Life variable annuities are long-term investments that can help you grow your retirement savings through a diverse selection of investment options while deferring taxes until you’re ready to take retirement income.

A registered index-linked annuity is a tax-deferred contract that allows you to pursue growth without being invested directly in the market. Instead, growth is linked to the performance of an index (such as the S&P 500® index). It also provides levels of protection against the amount of loss you can incur.

Pacific Life fixed indexed annuities are designed to protect your principal while providing growth opportunity based on the positive movement of an index creating a source of income that lasts for life and providing a guaranteed death benefit for loved ones.

Protect and grow your principal at a fixed rate to create a source of lifetime income and help provide for loved ones through a death benefit with a Pacific Life fixed annuity.

With a Pacific Life immediate annuity you can receive reliable income payments that begin on a date you choose within one year of purchase and last for life.

A fixed, deferred income annuity from Pacific Life provides reliable income payments beginning on a future date the annuitant chooses.

Life insurance is most commonly used to help protect your family from any financial effects of your and/or your spouse's death. Protect your family's financial well-being with life insurance, which can pay a death benefit to help replace a lifetime of your loved one's lost earning potential.

A hallmark of variable universal life insurance (VUL) is flexibility. In addition to death benefit protection, VUL offers the ability to allocate among purely market-driven and guaranteed investment options. With such a wide range of investment options, you may adjust your policy’s allocations to meet a potential lifetime of growth objectives and risk tolerances—all in one flexible policy.

When you need death benefit protection, the right life insurance policy may also help protect against market downturns. Indexed universal life insurance (IUL) offers the growth potential of index-based interest crediting rates and the protection of guaranteed minimum interest crediting floors.

Quality term life insurance from a premier life insurance carrier. Protect your family or business for the term period of your choosing at competitive premiums.

Universal Life Insurance (UL) provides death benefit protection with cash value growth potential, guaranteed minimum interest crediting rates, and flexible options for customizing coverage for your needs.

Pacific Life offers a full range of employee benefits, available through your employer, for your added health and financial well-being.

From dental exams to paycheck protection, our coverages can help provide you and your family peace of mind.

Submit a claim for coverages available through your employer.

Introducing Pacific Life Workforce Benefits that deliver employee value and meet employers' needs for simplicity and dependability in an ever-changing workplace.

Reduce your administrative tasks and time with a powerful, yet simple approach to managing group benefits.

Quality benefits your employees can rely on that are easy and friction-free to use and manage.

The Institutional Retirement Solutions Group offers a holistic approach that provides a seamless and integrated experience for our clients. We leverage Pacific Life’s nearly 160 years of financial strength to deliver retirement security and solve the critical need for institutional income solutions.

A leader in the Pension Risk Transfer market since 1941, we help provide retirement security for participants and deliver best-in-class performance and high-touch client service.

Partnering with our clients to deliver customizable lifetime income solutions that cater to the full spectrum of retirement plan needs.

Introducing Pacific Life Workforce Benefits. A new, totally unified experience that integrates group benefits, from quotes to claims. Better for your clients. Better for your business.

Making you a hero for your clients with seamless solutions from start to finish.

Quality products your clients need that are easy and friction-free to use and manage.

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

How do I…

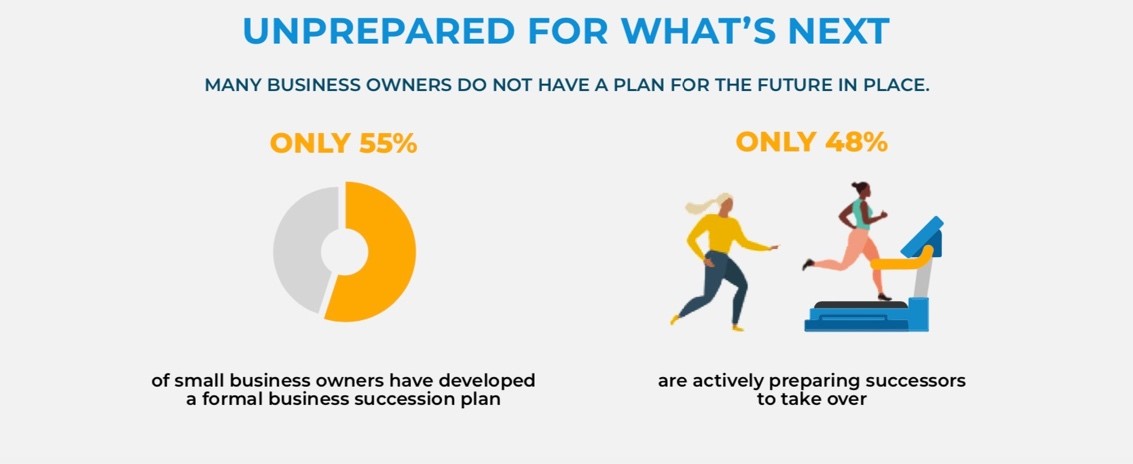

You want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can help ensure your business stays in stable hands.

You want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can help ensure your business stays in stable hands.

Your business represents countless hours of planning and plenty of hard work. You want to protect it—now and after you’re gone, from retaining your workforce and improving operating expenses to writing a succession plan. We have resources that can help promote the growth, success and longevity of your business.

A business protection plan guards the enterprise against the unexpected. It also lays out a clear plan for the future. Your plan addresses the following: lining up the next generation of leadership; a buy-sell agreement, which leaves no ambiguity about future ownership of the company; and protections and benefits for employees, so your company attracts—and retains—a strong workforce.

Source:

Deloitte Business Succession Planning

Yes. It’s as tempting to put off crafting a succession plan as it is to put off writing a will. But you cannot assume everyone knows your wishes about the future of your company. Not spelling things out could lead to confusion and frustration that ultimately harms the business—and tarnishes your legacy as a business owner. So, move succession planning up on your to-do list.

Source:

Wilmington Trust, “Wilmington Trust Survey Reveals Vast Majority of Business Owners Unprepared to Sell Business or Transition, Even as Many Approach Retirement Age”

A buy-sell agreement makes things clear and easy. This document is a legally binding contract that smooths the transition of business ownership. It also protects your family and the business by outlining a clear path for distribution of the business owner’s share. Getting such an agreement in place eases everyone’s minds and infuses the leadership group with confidence about the future of the business.

Source:

Deloitte Business Succession Planning

Home

Now I can rest assured that everything I love most in the world is protected.

Could your company thrive without you? Keep your business growing and strong—and your family protected during the transition.

View our infographic illustrating 5 elements of a strong succession plan.

Offers death benefit protection with tax deferred cash value build up, and tax-free access to the cash value via policy loans and withdrawals.

How may I transition the ownership of the business? |

Without proper planning, the sudden death or disability of a small business owner may have a devastating impact on the business, the business’ employees, and the other business owners. It may also have a significant financial impact on the business owner’s family. A properly structured business continuation plan (i.e. a buy-sell agreement) funded with life insurance may help to minimize the impact for both the business and the business owner’s family. Talk to your financial professional to learn more.

What is a business continuation plan for a business with many owners? |

Because a business with multiple owners may need flexibility, there are a variety of ways to structure a buy-sell arrangement, including Entity Purchase Buy-Sell, Cross-Purchase Buy-Sell, Wait-and-See Buy-Sell, and a One-Way Buy-Sell. Talk to your financial professional to help you discover what strategy may be right for you based on your business planning needs.

How do I help protect my business against the loss of a key employee? |

The success of a business may hinge on the ideas and leadership provided by a key executive. The sudden death of that key executive may have a severe economic impact on the business due to the loss of that executive’s unique skills and abilities. Additionally, the business may have to spend substantial amounts of cash to recruit and train the replacement executive. A prudent strategy to protect the business during the transition period is key person life insurance. Talk to your financial professional for details.

How can my business stand out in today's competitive climate? |

Whether you are looking to provide your employees a comprehensive 401(k) or a plan that incentivizes key employees only, you may fund a variety of customized solutions with our mutual funds, annuities, and life insurance. We offer professional, consultative support and quality financial products to help you complete your employee benefits package. Talk your financial professional and qualified and independent tax and legal advisors for details.

How can I help provide a comfortable retirement for my employees? |

Inadequate retirement savings is not only a concern for the owners and employees of a business but also for their families. For those close to retirement, the problem can be two-fold: how to provide for their families and how to save for retirement in a limited timeframe if the employee dies prior to retirement. A split-funded defined benefit plan funded with life insurance and other assets/investments may be able to provide both meaningful death benefit protection and supplemental retirement benefits. Talk to your financial professional to help you discover if this or another strategy using life insurance or another financial product may be right for you based on your business planning needs.

What if I want my business to end up being employee-owned? |

One way to plan is with an Employee Stock Ownership Plan (ESOP). An ESOP is a special type of qualified profit-sharing plan that invests primarily in employer securities. If an S- or C-Corporation owner doesn’t have an heir, co-owner, or outside buyer interested in taking over the business, or wants the business to end up being employee-owned, an ESOP may be an effective vehicle for creating a source of funds to purchase the owners’ interest in the company. Not only does the ESOP create a buyer for the business owner’s stock but a C-Corporation business owner (but not an S-Corporation owner) can use the sale proceeds to purchase “qualified replacement property” [IRC Sec. 1042(c)(4)(A)] and defer taxation on the sale of the stock to the ESOP. This allows a C-Corporation owner to sell part or all of the business to the ESOP without immediate taxation and use the proceeds to diversify assets through the purchase of qualified securities. Consult with your independent legal and tax advisors for additional details.

How can I protect my business from estate taxes? |

Typically, there are two ways to plan. One is the use of life insurance within an irrevocable life insurance trust (ILIT) and the other is the use of business assets to pay life insurance premiums and hold the life insurance as a business-owned asset used in a buy-sell arrangement (entity redemption). The determination is generally based on your estate tax liability and other tax considerations. Consult with your independent legal and tax advisors for additional details.

Family / Estate Planning

A plan that includes life insurance can help provide liquidity and equality in a family business succession.

Estate Planning / Family

Creating a detailed succession plan is paramount for a smooth and profitable transition.

Estate Planning / Family

Taking a proactive approach to passing on your assets can help bring peace of mind to you and your family.

Being happily retired looks different for everybody. Maybe you want steady retirement income that lasts or supplemental income to help you meet the unexpected in life.

LEARN MORE

For you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MORE

You don’t know what the future has planned for you, but you want to be prepared for the unexpected and be able to achieve your goals.

LEARN MOREBeing happily retired looks different for everybody. Maybe you want steady retirement income that lasts or supplemental income to help you meet the unexpected in life.

LEARN MOREFor you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MOREYou don’t know what the future has planned for you, but you want to be prepared for the unexpected and be able to achieve your goals.

LEARN MORELife insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

The primary reason for life insurance is death benefit protection.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life's Home Office is located in Newport Beach, CA.

PL1.4B

Financial Professionals Sign-In

Life Insurance Annuities Annuities for RIAs Workforce Benefits Working With Us All Login SitesProducts & Solutions

Life Insurance Annuities Employee Benefits Institutional Solutions Employer SolutionsMenu